Our pensionTech: Built for Inclusion. Designed for Scale.

Request a demoThe Heavy Lifting, Done Right.

Whether it's onboarding informal workers in remote locations, managing small-value contributions, or facilitating seamless withdrawals and insurance claims, our platform does the heavy lifting — reliably, securely, and affordably. Built with a microservices architecture and tested across diverse markets, our pensionTech is fully customizable for your regulatory, product, and delivery environment.

Global Reach

Adaptable to your specific regulatory, product, and delivery requirements while maintaining core functionality and security standards.

Microservices

Modern architecture enabling rapid customization, seamless integration, and scalable deployment across cloud and on-premise environments.

Fully Customizable

Adaptable to your specific regulatory, product, and delivery requirements while maintaining core functionality and security standards.

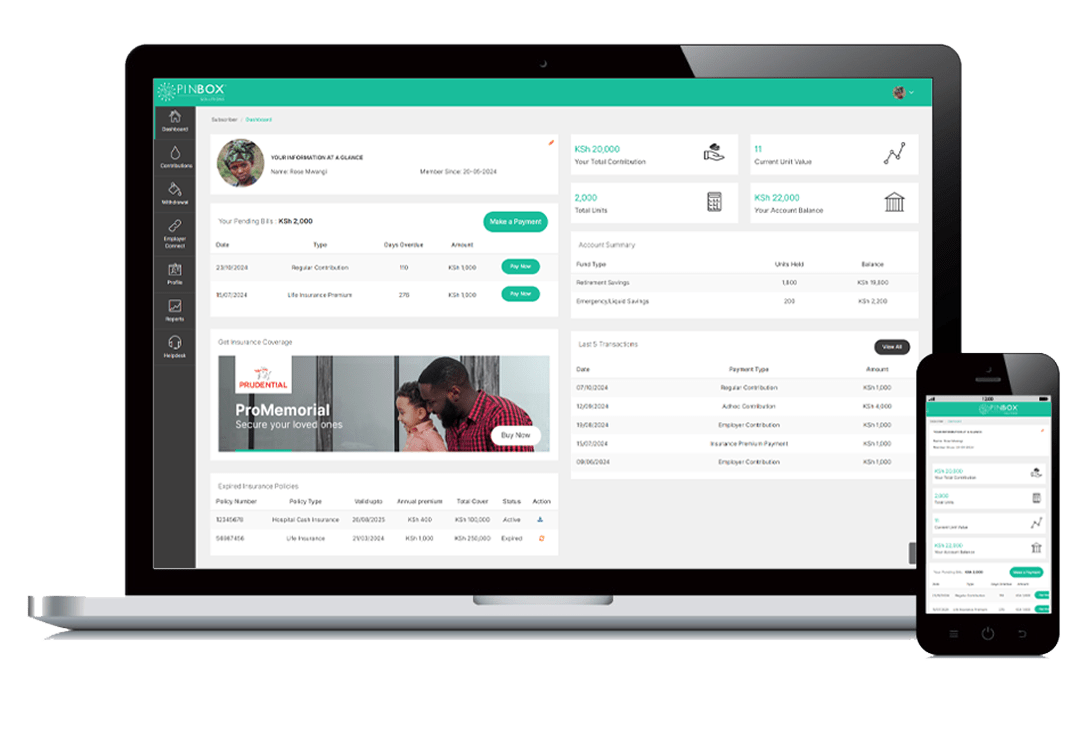

A Scalable Digital Platform for Inclusive Pensions

Key pensionTech Features and Functionalities

Platform Architecture & Deployment

These features emphasize the core tech, scalability, and ease of launch:

A Scalable Digital Platform for Inclusive Pensions

Custom-built to serve informal, self-employed, and salaried workers with full support for claims, payouts, and eligibility.

Microservices Architecture

Deployed on cloud or on-prem; supports agile customization and seamless system integration.

Rapid Deployment, Low Start-Up Costs

Avoids capital-heavy system builds. Integrates quickly with DPI, DFS, and ecosystems via secure APIs.

Operational Efficiency & Business Model

Focuses on cost-effectiveness and how your model supports financial sustainability:

Modest Start-up Costs

Eliminates upfront capex and design risks of building from scratch.

Aligned Commercial Model

Transparent fee structure—front-end fees + AMC + success-based license fees linked to AUM and active accounts.

Low Operating Costs

Partners operate on a variable-cost basis without needing new infrastructure. Fast path to sustainable unit economics.

Ecosystem Integration & Migration Support

Highlights how the platform connects and enhances broader pension delivery:

Demand Aggregation Model

No need for building retail networks. Aggregators handle bulk assets and premiums - not micro-transactions.

Option for Existing Schemes

Pension funds can migrate existing mandatory DC schemes to reduce servicing costs and enhance governance.

Automated Accounting / Reconciliation

Built-in automated recon and exception reporting through regulated payment channel integration.

A User-Centric Platform with Built-In Governance

Designed with the end-user in mind, featuring intuitive interfaces and comprehensive governance tools

Inclusive & Flexible Subscriber Experience

Focuses on what the end user gets - simplicity, flexibility, and accessibility.

Integrated Financial Security

One digital account for retirement, emergency, and goal-based savings + embedded insurance.

Flexible Contributions

Adaptive triggers: manual, auto-debit, QR — aligned with user income patterns.

Simple, Familiar UI/UX

Access via WhatsApp, USSD, web - frictionless onboarding and support.

Portability, Personalization & Reach

Highlights portability, segmentation, and inclusive delivery, especially for informal workers.

Portable, NID-Linked Accounts

Universal accounts linked to national ID - portable across jobs and life stages.

Segmented, Targeted Outreach

Non-linear distribution model adaptable by job type, region, and delivery channel.

Tailored for Every Saver

Fully customizable savings flows—no penalties, aligned with goals and earning rhythms.

Trust, Governance & Transparency

Demonstrates back-end accountability, oversight, and protections for stakeholders and users.

Targeted Incentive Delivery

Enables direct, leakage-free delivery of subsidies or matched savings via NID-linked accounts.

MIS & Governance Dashboards

Auto-generated dashboards for all stakeholders - monitor SLAs, performance, and outcomes.

Built-In Consumer Protection

Real-time grievance tracking + automatic escalations build user trust and deter mis-selling.

Built for Performance & Security

Our platform combines cutting-edge technology with proven security standards to deliver reliable, scalable solutions for pension systems worldwide.

Cloud & On-Premise Deployment

Flexible deployment options to meet your infrastructure requirements and regulatory constraints.

API-First Architecture

Seamless integration with existing DPI, DFS ecosystems, and third-party services through secure APIs.

Enterprise-Grade Security

Bank-level security protocols with end-to-end encryption and comprehensive audit trails.

Multi-Channel Access

WhatsApp, USSD, Web, Mobile App

Secure by Design

End-to-end encryption & compliance

Real-time Analytics

Live dashboards & reporting

Global Standards

ISO 27001, SOC 2 compliant

Ready to Transform Your Pension System?

Join governments and organizations worldwide who are using our pensionTech platform to deliver inclusive, scalable pension solutions to millions of informal workers.

Schedule a Demo